October 31, 2023

Greetings Everyone,

Happy Halloween. If any revelers are out partying tonight, stay in costume until Thursday morning, and there may be a door prize for you at Hometown Helena this week! In any event, be careful this evening if you’re out and about. Please watch out for the little trick or treaters.

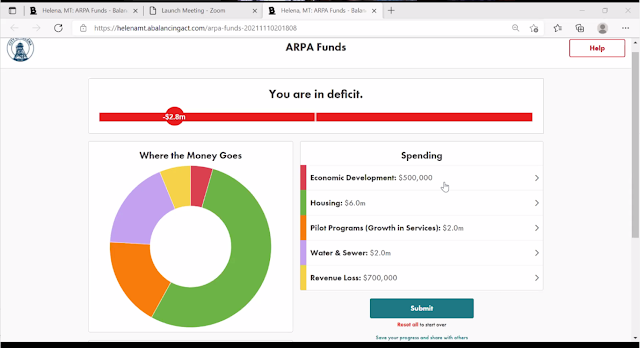

We’re going to make one more attempt at getting deeper understanding of the property tax situation here in Helena, in the county, and at the state level (see below) this week at Hometown Helena. Peter Strauss has arranged some interesting presentations for our learning opportunity this week. Many thanks Peter. In a previous post I referred to Montana’s property tax system as ‘Byzantine.’ It’s still Greek to me!! I’m hoping to learn more this week at Hometown. What I have learned over the last 40 years is that Montana relies primarily on the property tax to fund local governments.

I’ve been trying to think of this in terms of ‘Property Tax 101.’ What are the essentials we all ought to know in order to understand our property taxes?

What its a mill, anyway? A mill is 1/10th of a penny. That equates to $1 of revenue for each $1000 of assessed valuation.

What is a mill’s value in the city of Helena? In the county of Lewis and Clark? I’m still not sure. Come Thursday morning. And maybe we’ll find out.

City Commissioner Sean Logan has been addressing this on his Commission Facebook Page. Here’s some information from his personal situation that he is willing to share with the public:

Property taxes: January 2020 = $313. December 2023 = $419 (34% increase).

In FY ’23 the city levied 178.87 mills. For FY ’24 the city will levy 148.77 mills. The city budget, however, increased in its dollar amount, from approximately $105 million to $110 million. So, while the city lowered the mills, the revenue increased due the increased value of the properties being taxed.

And, of course, the whole discussion is now even more complicated by the dispute over the 95 mills levied for K-12 education. Is a county supposed to levy the 95 mills, or the dollar equivalent thereof is the question. I understand that question is now in the hands of the courts, and no resolution of that question is expected until next spring.

To this layman, trying to grasp all this is like a ’taffy pull.’ Very difficult to sort it all out. We’ll see what we can do in an hour this Thursday, with some experts on hand to help us understand.

So, we hope you can join us Thursday morning on the 6th floor of the Montana Club, or that you can zoom into the meeting from your own home.

Jim Smith

406-949-1002

Comments

Post a Comment